Facts About Amur Capital Management Corporation Uncovered

Table of ContentsHow Amur Capital Management Corporation can Save You Time, Stress, and Money.A Biased View of Amur Capital Management CorporationThe Best Guide To Amur Capital Management CorporationA Biased View of Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals ExplainedThe Only Guide for Amur Capital Management Corporation

The business we follow require a solid track document usually at the very least one decade of operating background. This implies that the firm is most likely to have faced a minimum of one economic decline which monitoring has experience with adversity as well as success. We look for to omit companies that have a credit history quality listed below investment quality and weak nancial stamina.A business's capability to raise rewards continually can show protability. Firms that have excess cash ow and solid nancial positions usually pick to pay rewards to bring in and reward their shareholders. As a result, they're often much less volatile than stocks that do not pay rewards. Beware of reaching for high yields.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

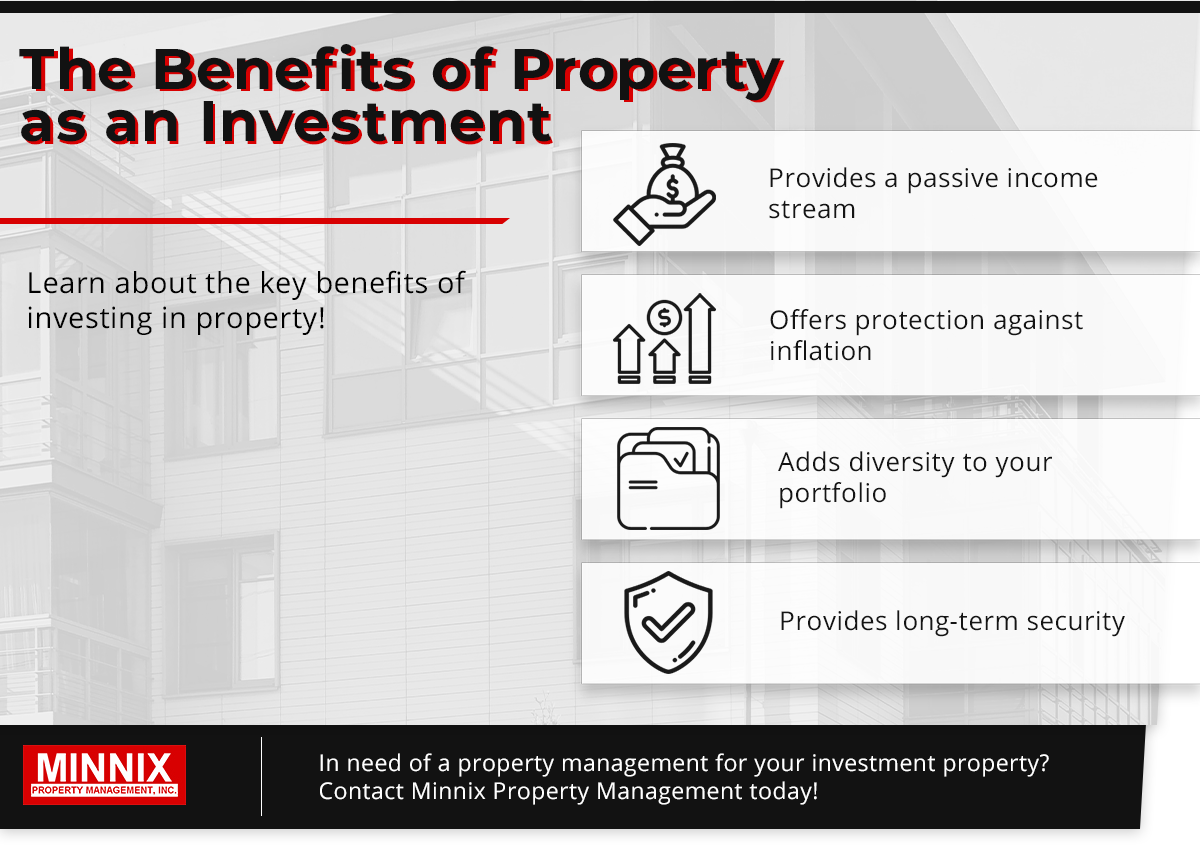

Diversifying your investment profile can assist protect against market uctuation. Look at the dimension of a business (or its market capitalization) and its geographical market U.S - investment., established global or arising market.

Regardless of exactly how very easy electronic investment management platforms have actually made investing, it shouldn't be something you do on an impulse. If you determine to go into the investing globe, one point to take into consideration is how long you in fact desire to invest for, and whether you're prepared to be in it for the lengthy haul - https://allmyfaves.com/amurcapitalmc?tab=Amur%20Capital%20Management%20Corporation.

There's a phrase common linked with investing which goes something along the lines of: 'the sphere might drop, yet you'll desire to make sure you're there for the bounce'. Market volatility, when financial markets are going up and down, is a common sensation, and long-term might be something to aid smooth out market bumps.

The Basic Principles Of Amur Capital Management Corporation

Keeping that in mind, having a long-lasting technique can aid you to gain from the wonders of compound returns. Joe spends 10,000 and earns 5% dividend on this investment. In year one, Joe makes 500, which is repaid right into his fund. In year 2, Joe makes a return of 525, because not only has he made a return on his initial 10,000, however likewise on the 500 spent reward he has actually earned in the previous year.

The 8-Minute Rule for Amur Capital Management Corporation

One method you might do this is by obtaining a Supplies and Shares ISA. With a Stocks and Shares ISA. best investments in canada, you can spend as much as 20,000 annually in 2024/25 (though this is subject to transform in future years), and you do not pay tax on any returns you make

Getting going with an ISA is actually easy. With robo-investing systems, like Wealthify, the effort is provided for you and all you require to do is choose just how much to invest and select the danger degree that suits you. It may be just one of the few instances in life where a much less psychological technique could be beneficial, however when it comes to your financial resources, you might wish to pay attention to you head and not your heart.

Staying concentrated on your lasting goals can aid you to prevent unreasonable decisions based on your emotions at the time of a market dip. The tax treatment depends on your private scenarios and might be subject to transform in the future.

An Unbiased View of Amur Capital Management Corporation

Nonetheless investing goes one action better, assisting you attain personal objectives with three substantial advantages. While saving ways establishing aside component of today's cash for tomorrow, investing ways placing your money to work to possibly earn a better return over the longer term - passive income. https://www.dreamstime.com/christopherbaker10524_info. Different courses of financial investment properties money, repaired interest, property and shares normally generate different degrees of return (which is about the danger of the financial investment)

As you can see 'Growth' possessions, such as shares and residential property, have historically had the very best total returns of all possession classes however have likewise had larger heights and troughs. As an investor, there is the prospective to earn funding development over the longer term as well as an ongoing earnings return (like dividends from shares or lease from a building).

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Inflation is the recurring rise in the price of living with time, and it can influence on our monetary health and wellbeing. One method to help outpace inflation - and generate positive 'actual' returns over the longer term - is by spending in properties that are not simply efficient in supplying higher earnings returns however also offer the possibility for funding growth.